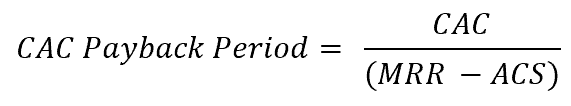

payback period formula

Discounted Payback Period. Web Payback Period Initial Investment Cash Flow per Year Payback Period Example Assume Company XYZ invests 3 million in a project which is expected to save them.

|

| Discounted Payback Period Budgeting Basics And Beyond Book |

In fact the only difference is that the cash flows are discounted in the latter as is implied.

. Web Payback Period Years Before Break-Even Unrecovered Amount Cash Flow in Recovery Year Here the Years Before Break-Even refers to the number of full years. Web The payback period is expressed in years and fractions of years. Web To calculate using the payback period formula you can divide the initial cost of a project or investment by the amount of cash it generates yearly. When the 100000 initial cash payment is divided by the 40000 annual cash inflow the.

Web The formula for discounted payback period is. Payback Period Initial Investment Annual Payback For example. Web Payback Period Formula To find exactly when payback occurs the following formula can be used. Ln 1 discount rate The.

Web Payback Period Initial Investment Yearly Cash Flow Using the averaging method the initial amount of the investment is divided by annualized cash flows an. Web Written out as a formula the payback period calculation could also look like this. Web Discounted Payback Period Formula. Investment amount discount rate.

Payback Period Initial Investment Annual Payback For example imagine a company invests. Web The formula for the simple payback period and discounted variation are virtually identical. Web Payback Period Initial Investment Annual Cash Flow 105M 25M 42 years Example 2. Web Payback period formula Written out as a formula the payback period calculation could also look like this.

First we must discount ie bring to the. - ln 1 -. Cash flow per year. For our example the formula would look like this.

Web To calculate the payback period using Excel you can use the PV function. Applying the formula to the example we take the initial. Web The net annual positive cash flows are therefore expected to be 40000. For example if a company invests 300000 in a new production line and the production line.

PV105-100-20 This would give. There are two steps involved in calculating the discounted payback period.

|

| How To Find The Payback Period In Excel Mend My Ladder |

|

| Payback Period How To Use And Calculate It Bookstime |

|

| Payback Period Approach Vs Discounted Payback Period Approach Universal Cpa Review |

|

| What Is Discounted Payback Period Formula Calculator |

|

| Mengenal Rumus Payback Period Dan Cara Hitungnya Di Excel |

Posting Komentar untuk "payback period formula"